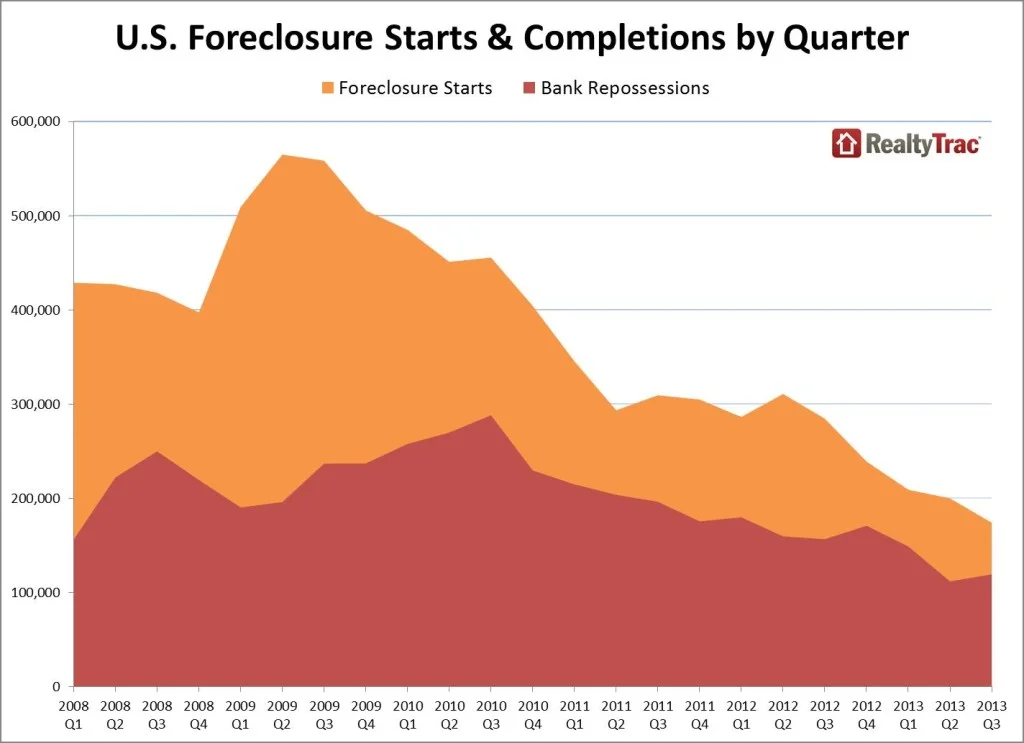

California is among the states that saw a drop in foreclosure starts in the July-September quarter of 2013. Nationwide, foreclosures are at a seven year low, declining 13% from the previous quarter and 39% from a year ago – and down a total of 59% in California.

The drop in foreclosure stats is believed to be due to a gradually improving housing market, rising home prices, improving employment numbers, and fewer troubled loans. There was a slight increase in completed foreclosures from Q2 to Q3, rising 7% but down 24% from the same time last year. In California, REOs increased 19% in Q3 – but not bad compared to New York’s 65% increase.

At the peak in 2010, there were roughly 1.05 million foreclosures, and the numbers have been declining ever since.